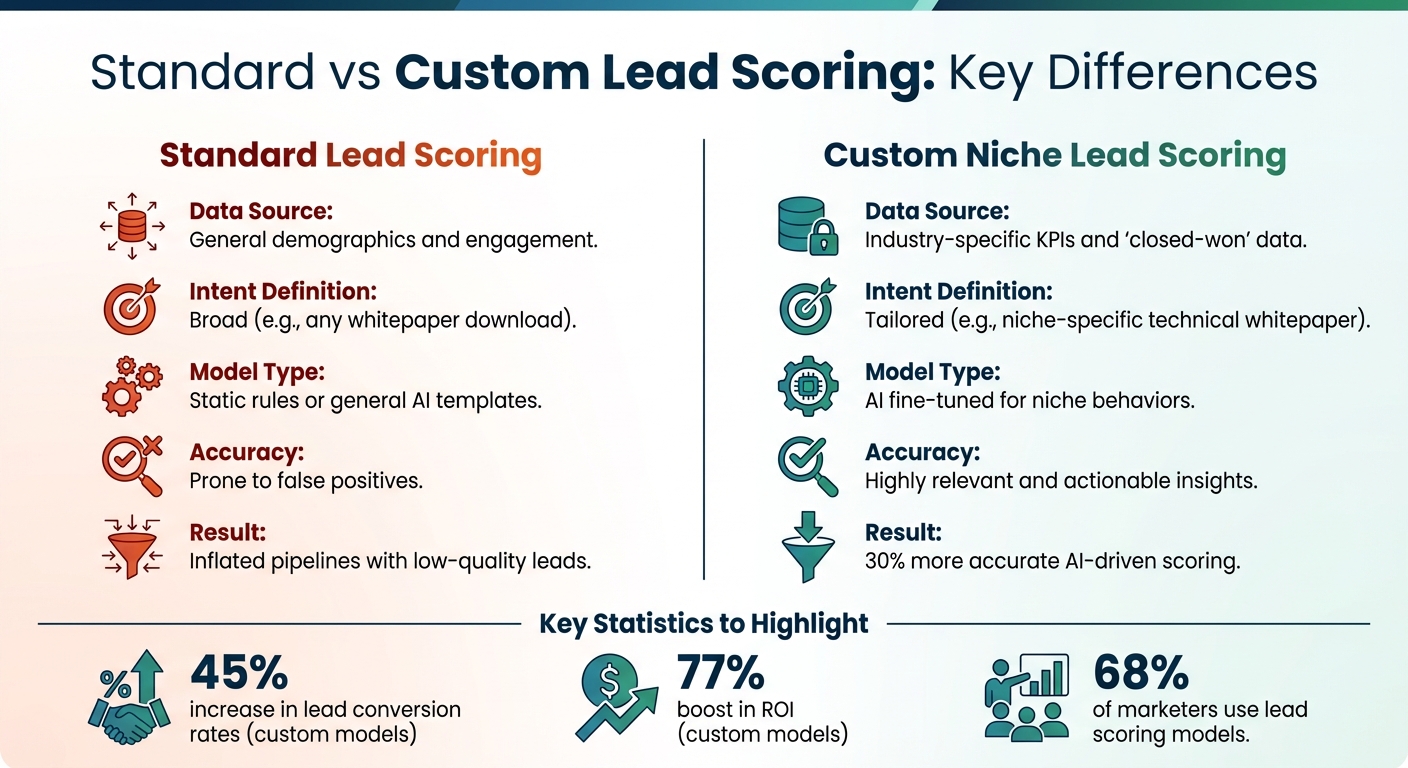

Lead scoring helps businesses prioritize leads by assigning numerical values based on potential conversion likelihood. While 68% of marketers use lead scoring models, many rely on generic frameworks that fail to address the specific needs of niche industries. Tailoring lead scoring for niche markets ensures higher accuracy by focusing on industry-specific data, such as firmographics, technographics, and intent signals. Companies that use customized, AI-driven scoring models report a 45% increase in lead conversion rates and a 77% boost in ROI.

Key Takeaways:

- Generic models fail: Standard scoring often inflates pipelines with low-quality leads due to overemphasis on generic metrics like email opens.

- Niche-specific data matters: Incorporate firmographics, technographics, and behavioral data unique to your market.

- AI improves precision: AI-driven models fine-tuned with enriched data improve accuracy by 30% and boost lead conversion rates.

- Regular updates are critical: Models updated quarterly are 22% more accurate, ensuring alignment with shifting buyer behaviors.

By replacing one-size-fits-all approaches with tailored scoring systems, businesses can focus efforts on the leads most likely to convert, saving time and driving revenue growth.

The SIMPLEST Way To Build An AI Lead Scoring Assistant (AI Automation)

sbb-itb-0ae5139

How Niche Markets Differ from Broad Markets

Standard vs Custom Lead Scoring Models Comparison

What Makes a Market a Niche Market

A niche market is a focused and specific segment of a larger market, designed to meet the unique needs, preferences, or identities of a particular group [6][9]. To put it simply, broad markets cast a wide net, while niche markets drill deep into a smaller, highly engaged audience [6]. Instead of trying to appeal to everyone, businesses in niche markets zero in on a dedicated group with precise demands.

Here’s an interesting stat: niche websites enjoy 53% higher engagement rates compared to general-topic sites. Plus, nearly half (45%) of niche website creators report having a more loyal audience [6]. Between 2010 and 2020, the number of microbusinesses targeting niche markets grew by 34% [7]. Why? Buyers in these markets crave personalized and tailored solutions that address their specific challenges – and they’re often willing to pay extra for that level of expertise [6][8].

"Going too broad prevents you from speaking the language of the niche market. That can make it harder to establish trust and credibility." – Jimi Gibson, Vice President of Brand Communication, Thrive [6]

What sets niche buyers apart is the depth of their profiles. These go beyond surface-level demographics, incorporating firmographics (like company size or structure), psychographics (values and attitudes), and detailed behaviors [7][8]. For example, a cybersecurity firm catering to healthcare providers has vastly different needs than a general IT services company. These nuanced buyer profiles create challenges that standard lead scoring models often fail to address.

Why Standard Lead Scoring Falls Short

Generic lead scoring models tend to rely on broad, one-size-fits-all approaches that ignore the complexities of niche markets [1]. This often leads to an influx of false positives – leads that appear promising but ultimately don’t convert. The root problem? These models fail to capture the unique buying signals that matter most in niche industries [1].

For instance, what qualifies as a "hot lead" can vary dramatically by industry. A healthcare buyer might value a specific technical whitepaper, while a general IT buyer might not. Standard models often overemphasize generic metrics like email opens, which don’t always indicate genuine purchase intent [1][11].

| Feature | Standard Lead Scoring | Custom Niche Lead Scoring |

|---|---|---|

| Data Source | General demographics and engagement | Industry-specific KPIs and "closed-won" data |

| Intent Definition | Broad (e.g., any whitepaper download) | Tailored (e.g., niche-specific technical whitepaper) |

| Model Type | Static rules or general AI templates | AI fine-tuned for niche behaviors |

| Accuracy | Prone to false positives | Highly relevant and actionable insights |

In niche B2B markets, where sales cycles are longer and involve multiple decision-makers, standard scoring models often fall short. These models are designed for simpler, more transactional sales funnels and can’t keep up with the nuanced, consultative buying journeys typical in niche industries [3][11]. On the flip side, companies that invest in enriched, niche-specific lead data report 30% more accurate AI-driven scoring results [1]. This kind of precision doesn’t just save time – it directly impacts revenue.

Collecting and Using Industry-Specific Data

At the heart of any effective niche lead scoring model lies one key element: targeted data. Companies leveraging enriched intent data have reported up to an 85% boost in lead conversion rates and 30% more precise AI scoring outcomes [1]. The difference between a generic scoring model and one that actually drives revenue comes down to the quality and relevance of the data you provide.

"Your AI model is only as good as the data you input into it. Incomplete, out-of-date CRM data… will result in bad scoring." – Intent Amplify [1]

For niche markets, standard scoring models often miss the mark because they overlook critical, industry-specific data points. For instance, a cybersecurity company selling to healthcare providers will need to track vastly different signals compared to a general IT services provider. This means looking beyond basic demographics to include:

- Firmographics: Information like industry sub-verticals, funding rounds, and company size.

- Technographics: Specific software in use (e.g., Salesforce paired with Snowflake).

- Hiring Signals: Indicators like open cybersecurity roles.

- Intent Data: Behaviors such as researching niche topics like ransomware or downloading whitepapers.

Where to Find the Right Data

To build a scoring model tailored to your niche, start by analyzing your CRM’s historical deal data. Look for patterns in previous wins to define what a "good fit" customer looks like. However, internal data alone won’t give you the full picture – you’ll need external data sources as well.

Here’s where you can look:

- Website Analytics: Track high-intent actions like visits to pricing pages or downloads of gated resources.

- Marketing Automation Tools: Gather insights from email engagement or webinar attendance.

- Technographic Tools: Platforms like BuiltWith or Wappalyzer can reveal which technologies prospects use, helping you identify compatibility or opportunities to replace competitors.

- Job Boards: Open roles in areas like "Revenue Ops" may signal a company preparing for growth.

- Third-Party Data Providers: Services like Coresignal, Apollo, ZoomInfo, and Clearbit offer enriched firmographic and contact data.

- Manual Research: LinkedIn profiles, directories like G2 or Clutch, and Crunchbase can help uncover niche-specific companies and track signals like funding rounds or executive shifts.

Here’s a quick breakdown of key data types and their strategic value:

| Data Type | Specific Data Points | Strategic Value |

|---|---|---|

| Firmographic | Industry, employee count, revenue, location, funding | Helps define the Ideal Customer Profile (ICP) and filter out poor matches. |

| Technographic | Current tech stack, specific software integrations | Identifies compatibility or opportunities to replace existing solutions. |

| Demographic | Job title, seniority level, department, tenure | Ensures you’re targeting the right decision-makers. |

| Intent/Behavioral | Hiring trends, pricing page visits, branded keyword searches | Indicates buying intent and readiness. |

Once collected, this data needs to be refined and tailored to meet the unique demands of your niche.

Adapting Data for Your Industry

Raw data is only the starting point. To make it actionable, you’ll need to transform it into insights specific to your niche. This process involves feature engineering – turning raw data into predictive signals for your lead scoring model [1]. For example, a lead in the cybersecurity sector who downloads a ransomware whitepaper and then visits your pricing page should receive a much higher score than someone who simply opens an email.

To fine-tune your approach, analyze the profiles of your most valuable customers. For instance, a SaaS company might discover that a high Alexa rank is a strong predictor of long-term value for a specific segment [13].

You can also refine your CRM filters to focus exclusively on niche-specific leads, ensuring irrelevant traffic doesn’t dilute your results [4]. Negative scoring can help too – deduct points for poor-fit indicators like leads from non-target industries or regions that don’t align with your product.

One success story comes from Druva, a data protection company. In 2024, they replaced their manual lead scoring process with an AI-driven model that combined website behavior, firmographics, and enriched CRM data. By identifying patterns – such as prospects engaging with ransomware-related whitepapers followed by demo requests – Druva saw a significant jump in lead-to-opportunity conversion rates and sped up outreach by their Sales Development Representatives [1].

Since niche buyer behavior can change quickly, keeping your AI model up to date is critical. Models refreshed quarterly are 22% more accurate than those updated less frequently [1]. Establish a feedback loop with your sales team to capture real-world adjustments and retrain your model every three months [5]. This ensures your scoring stays sharp and aligned with market shifts.

Creating Custom Lead Scoring Models Step by Step

After discussing the importance of gathering industry-specific data, let’s dive into how to transform those insights into a tailored lead scoring model. Instead of tweaking a generic framework, focus on building a model that captures the unique buying signals of your niche. Companies leveraging AI-driven lead scoring models have reported up to a 30% boost in sales efficiency when these models are fine-tuned with industry-specific data[14]. Here’s how to create one from scratch.

Setting Up Custom Scoring Criteria

To start, identify the traits and behaviors that signal a lead is likely to convert within your niche. Move beyond generic demographics and include specific attributes like job roles, company size, or even technology preferences[2]. For instance, a cybersecurity firm targeting healthcare providers might prioritize leads such as "Chief Information Security Officer" at hospitals with 500+ employees. Meanwhile, a real estate SaaS company could focus on ZIP codes and property portfolio sizes.

Assign scores to high-value attributes – like +10 points for a C-level title – and deduct points for factors indicating a poor fit, such as -5 for a Gmail address or connections to competitors[12][18]. Define a qualification threshold (the minimum score a lead needs before being passed to sales) and refine it over time based on actual conversion data[2]. You can also implement score decay, which lowers a lead’s score after periods of inactivity (e.g., -2 points per week) to keep your focus on active prospects[12].

For B2B markets, consider aggregating scores from multiple contacts within the same organization. Methods like summing, averaging, or taking the maximum score can provide a clearer picture of overall account-level interest[12]. This tailored approach highlights why custom models often outperform standard ones.

Standard vs. Custom Models: A Comparison

The gap between standard and custom lead scoring models is hard to ignore. Standard models rely on fixed rules and broad demographics – think +5 points for opening an email – while custom models use machine learning to uncover patterns specific to your niche[17]. The downside of standard models? They often bloat pipelines with low-quality leads because they can’t distinguish between casual engagement and genuine buying intent.

Custom models, on the other hand, require more setup effort. To train an effective predictive model, you’ll need at least 40 qualified and 40 disqualified leads from the past 3 to 24 months[4][15]. However, the results are worth it: companies using AI-powered lead scoring report an average 45% increase in lead conversion rates[1].

"A health firm will not define intent in the same manner as a SaaS business or a retail business… The point is that the model learns what is important to your business, not theirs." – IntentAmplify[1]

Unlike static rule-based systems, custom models adapt dynamically using AI trained on historical data, offering improved accuracy and reduced bias.

Adding AI-Powered Analysis

Once your custom criteria are in place, AI-powered analysis takes your lead scoring to the next level by analyzing real-time behavior. AI turns lead scoring into a dynamic process, processing vast amounts of data – like website visits and email engagement – alongside firmographic details to detect subtle buying signals[14]. For example, actions like downloading a technical whitepaper can be transformed into predictive insights tailored to your niche[1].

Modern AI systems excel at real-time updates. If a lead downloads a ransomware whitepaper and visits your pricing page in the same session, the AI can instantly flag that lead as high-priority, ensuring your sales team focuses on those most likely to convert[16].

AI models also provide transparency. Tools using frameworks like SHAP or LIME explain why a lead received a particular score. For instance, "This lead scored 85 because they visited the pricing page twice, work at a company with 200+ employees, and align with your ideal customer profile in the healthcare sector."

To keep your AI model accurate, schedule automatic retraining – ideally every 15 days or at least quarterly[4]. Regular updates improve accuracy by 22% compared to models that aren’t refreshed as often[1]. Additionally, establish a feedback loop with your sales team to incorporate their insights, ensuring the model evolves with shifting buyer behaviors. Companies using AI-driven lead scoring report that 79% experience increased sales productivity[17].

How CRM Copilot.AI Supports Custom Lead Scoring

CRM Copilot.AI strengthens custom lead scoring for niche markets by combining AI-verified contact data, flexible filters, and seamless integration with platforms like Salesforce, Zoho, and HubSpot. Its "Minimum Viable Data Spec" consolidates buyer signals into a unified identity graph using stable IDs, ensuring your scoring models are tailored to your market’s specific needs[19]. This streamlined data integration enables precise AI analysis and smooth workflow automation.

AI-Verified Contact Data

To maintain the high data quality crucial for lead scoring, CRM Copilot.AI uses real-time validation. It applies identity resolution rules, such as prioritizing verified corporate email addresses, and employs deterministic matching (e.g., exact matches for email, domain, and name) to create dependable "golden records" for leads[19]. For non-corporate emails, the system cross-references firmographic data to avoid routing errors[19].

The platform also automates data cleansing by removing duplicates and standardizing formats – like unifying "VP" and "Vice President" – to ensure lead scores reflect accurate, consistent data[20]. Companies leveraging enriched lead data benefit from 30% more precise AI scoring[1], while predictive scoring users report building sales pipelines 30% faster by cutting time wasted on poor-fit leads[20].

"Predictive lead scoring succeeds when it predicts a rigorously defined outcome that your team agrees to act on." – Petronella Cybersecurity News[19]

Custom Filters and Automated Workflows

CRM Copilot.AI offers customizable filters to define scoring criteria that match your market’s unique buying behaviors. Filters can focus on factors like location, industry, company size, and job title, allowing you to assign positive scores for high-value attributes (e.g., +15 for target industries) and negative scores for disqualifiers like competitor domains or inactive leads[21].

Automated workflows further enhance efficiency by managing tasks like data enrichment, lead prioritization, and re-engagement campaigns. For instance, you can set a marketing-qualified lead (MQL) threshold – such as 70+ points for immediate sales follow-up – ensuring alignment between marketing and sales teams[21]. Running a new scoring model in "shadow mode" for a few weeks lets you compare its predictions with current manual processes, reducing risk and boosting team confidence in the system[19].

Integration with Major CRM Platforms

CRM Copilot.AI integrates directly with Salesforce, Zoho, and HubSpot, syncing verified contact data and custom lead scores into your existing workflows to eliminate manual data entry. Studies show that businesses using AI-powered lead scoring see 38% higher conversion rates and 28% shorter sales cycles[21]. Moreover, effective lead scoring can boost sales productivity by 30%, allowing teams to focus on genuine opportunities[21].

For example, when a lead’s score updates based on new actions – like downloading a whitepaper or visiting a pricing page – the change is instantly reflected in your CRM. This triggers workflows tailored to the lead’s behavior. Since only 27% of leads sent to sales are typically qualified[21], this level of automation ensures your team spends time on prospects with the highest potential to convert. By integrating smoothly with your CRM, CRM Copilot.AI supports ongoing refinement and testing of your scoring models, helping you stay ahead in lead management.

Testing and Improving Your Lead Scoring Models

After launching your custom lead scoring model, it’s crucial to keep testing and fine-tuning it. Markets evolve quickly – new competitors pop up, buyer behaviors shift, and strategies that worked last quarter might not hold up today. A good starting point is a holdout sample test. This involves locking your model parameters and testing them against historical data that wasn’t part of the original design. It’s an effective way to check if your scoring logic works beyond the data it was trained on, helping you evaluate its performance in real-world scenarios[22].

The key metric to watch is rank-ordering power – your high-scoring leads should convert at noticeably higher rates than your low-scoring ones. If your "A" and "B" scores aren’t driving better results than your "C" scores, the model needs adjustments, no matter how advanced the math behind it is[22]. For niche markets, you’ll also want to ensure the model performs consistently across industries, roles, and regions. Otherwise, you risk missing out on high-potential accounts[22].

Running A/B Tests and Tracking Performance

A/B testing is a great way to see how your new custom model stacks up against your current one. By splitting leads between the old and new models, you can compare key metrics like win rates and sales cycle times. In niche markets, using stratified sampling – grouping leads by attributes like industry or company size – helps ensure both groups are evenly distributed[26].

To set up your test, calculate the required sample size based on your baseline conversion rates and the effect size you’re aiming for. Most A/B tests should run for at least 45 days to align with typical lead conversion cycles. Use a two-sample proportion z-test to analyze conversion rates and keep an eye on multiple metrics, like conversion rates, lead conversion time, and Recall (how often your model correctly identifies actual positives)[26][25].

"A/B testing involves comparing two versions (A and B) to measure their impact on a specific metric. In our case, we will compare lead scoring models based on conversion rates and lead conversion time." – Arpit Rawat, Data Scientist, Sinch[26]

Another crucial step is ensuring your "hot" leads match your sales team’s capacity. For example, if your SDRs can handle only 20 high-priority leads daily, but your model flags 50, you’ll create bottlenecks and waste resources. Combine A/B test results with feedback from sales reps to make sure the "A" scores align with their real-world experience of lead quality[22][23]. These insights will shape the next round of refinements.

Refining Models Based on Sales Results

As your model runs, use conversion data and sales outcomes to make it more accurate over time. Track conversion rates for each score band and calculate model lift by comparing high-scoring leads’ conversion rates against your baseline[22][25]. Typically, models are trained with 80% of historical closed leads and validated with the remaining 20% as a test dataset[25].

Set up a quarterly review cycle to revisit point values and thresholds, especially when market conditions shift or new products are introduced. Keep an eye out for score drift, where score distributions change due to new lead sources or evolving buyer behaviors[22]. Major changes, such as entering new markets, pricing updates, or shifts in the economy, should prompt immediate retraining. In fast-changing niche markets, some businesses retrain their models every 15 days to stay on top of trends[23][4].

Clearly define what "conversion" means for your team – whether it’s moving from MQL to SQL or SQL to Closed-Won – and set a specific time frame for tracking, like 90 days[22]. Use a confusion matrix to evaluate performance, tracking True Positives, True Negatives, False Positives, and False Negatives. This can highlight areas where the model might misclassify leads[25]. Negative scores can also be applied to disqualifying traits, such as leads from non-target geographies, competitor domains, or those inactive for over 30 days[24][10].

"Refining a lead scoring model requires alignment between sales and marketing teams on lead definitions, KPIs, and attribution models. Clean data from consistent sources is crucial to avoid discrepancies." – Atticus Li, Growth & Experimentation Leader[23]

Conclusion

A refined scoring model is the key to success in niche markets. Customizing lead scoring for these markets allows businesses to focus on qualified prospects instead of wasting time on unproductive leads. Unlike one-size-fits-all approaches, custom scoring zeroes in on the specific buying signals that matter most in your niche[1].

Companies leveraging AI-driven lead scoring report impressive results: 45% higher conversion rates, 56% greater revenue attainment, and 22% better predictive accuracy when models are retrained quarterly[1]. These gains come from using your sales data to build tailored models, testing them thoroughly, and continuously improving them based on real-world performance.

"A model that gets your market will enable your team to forecast more accurately, prioritize better, and accelerate pipeline velocity, all without adding headcount or budget" – Ricardo Hollowell, Intent Amplify[1]

To implement these advanced models, you need the right tools. This is where CRM Copilot.AI shines. The platform simplifies the process by automating data enrichment and real-time prioritization. With features like AI-verified contact data, niche-specific search filters, and seamless integration with leading CRMs like Salesforce, Zoho, and HubSpot, CRM Copilot.AI empowers you to create and deploy custom scoring models – no data science expertise required. Automated workflows ensure your sales team always has a clear view of which leads to prioritize.

Start by defining your niche ICP (Ideal Customer Profile), include both positive and negative behavioral signals, and keep refining your model. The right leads are out there – you just need a system that helps you find them faster than your competitors.

FAQs

How does AI-powered lead scoring boost conversions in specialized markets?

AI-powered lead scoring can transform how businesses approach conversions in specialized markets. By analyzing customer data and spotting patterns tied to industry-specific behaviors, AI helps identify and prioritize leads that are most likely to convert. This means sales teams can focus their energy on high-value prospects, cutting down on wasted time and effort.

What makes AI particularly effective in niche markets is its ability to adapt to unique buying signals and preferences. Tailored AI models deliver more precise lead scoring and segmentation, ensuring that marketing and sales strategies align perfectly with the needs of your target audience. The result? Better conversion rates and shorter sales cycles.

Another advantage is that AI systems are always learning. They provide real-time insights, allowing businesses to refine their lead qualification process continuously. Over time, this adaptability ensures even better results and a more efficient approach to sales.

What key data points should you focus on when customizing lead scoring for niche industries?

To fine-tune lead scoring for niche markets, it’s essential to zero in on behavioral engagement metrics. These include actions like email opens or website visits, which can help gauge a lead’s level of interest. Beyond that, incorporating industry-specific KPIs – such as purchase frequency or how often a service is used – ensures your scoring aligns with the unique goals of your business.

Don’t overlook contextual signals either. Factors like job titles, company size, or specific behaviors that suggest a strong match for your product or service can provide valuable insights.

By weaving these focused data points into your lead scoring model, you’ll be better equipped to spot high-value prospects and foster deeper, more impactful engagement.

Why should lead scoring models for niche markets be updated regularly?

Regularly revisiting and fine-tuning lead scoring models for niche markets is crucial to staying aligned with shifts in buyer behavior, emerging industry trends, and changing market conditions. These updates ensure your model stays precise in identifying high-value prospects while keeping pace with evolving key performance indicators (KPIs).

By maintaining an up-to-date model, sales teams can zero in on the most promising leads, boosting efficiency and driving better outcomes in specialized industries.